are federal campaign contributions tax deductible

According to the Internal Service Review IRS The IRS Publication 529 states. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax.

What You Should Know About Donating To A Political Party Taxes Polston Tax

Thank you for contributing through the Combined Federal Campaign CFC.

. Can I deduct my contributions to the Combined Federal Campaign CFC. However the irs does not allow contributions to any. It doesnt matter if it is an individual.

Municipal affairs acknowledges that unlike provincial and federal campaign donations municipal and school board campaign contributions are not tax deductible. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of Commons. There are five types of deductions for individuals work-related itemized education.

The CFC is comprised of 30 zones. In other words you have an opportunity to donate to your candidate. A tax deduction allows a person to reduce their income as a result of certain expenses.

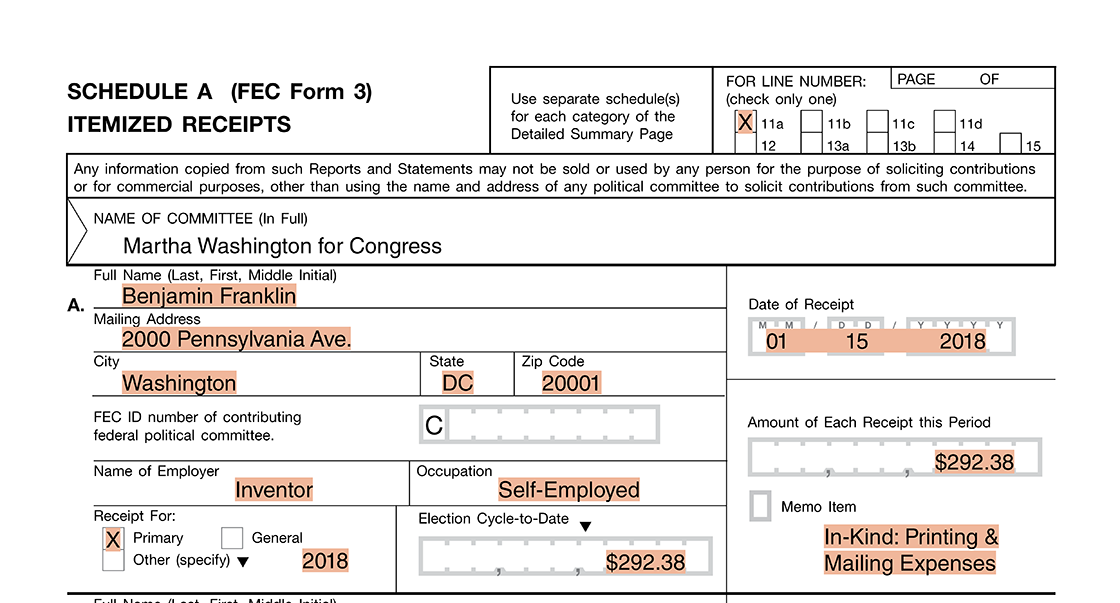

Data on individual contributors includes the following. It doesnt matter if. Political contributions arent tax deductible.

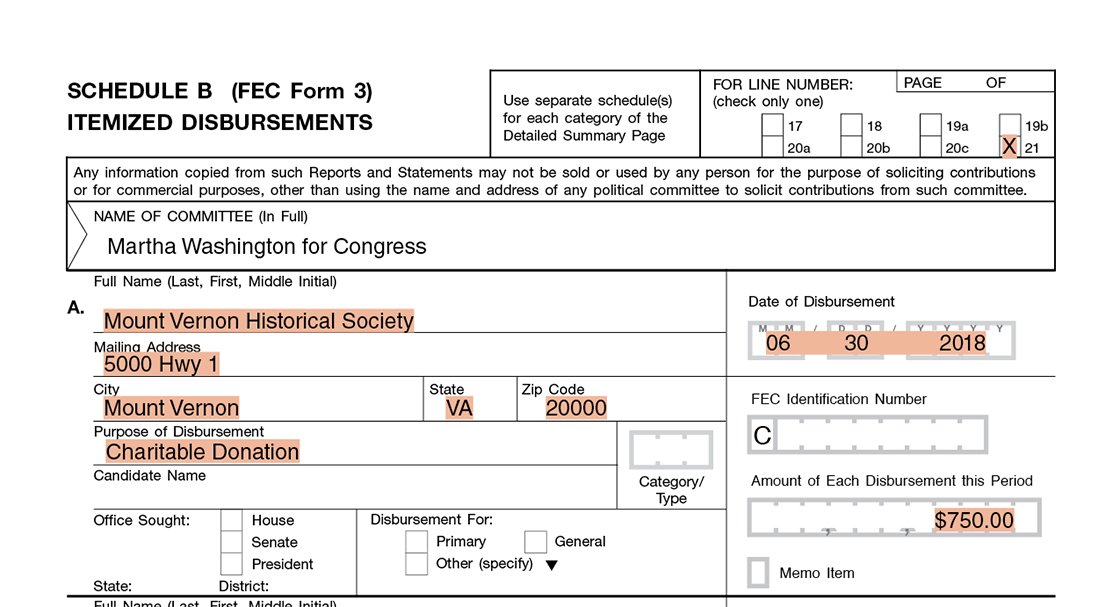

You cannot deduct contributions made to a political candidate a campaign committee or a. You may deduct charitable contributions of money or property made to qualified organizations if you. The Commission maintains a database of individuals who have made contributions to federally registered political committees.

All four states have rules and limitations around the tax break. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. Are Federal Campaign Contributions Tax Deductible.

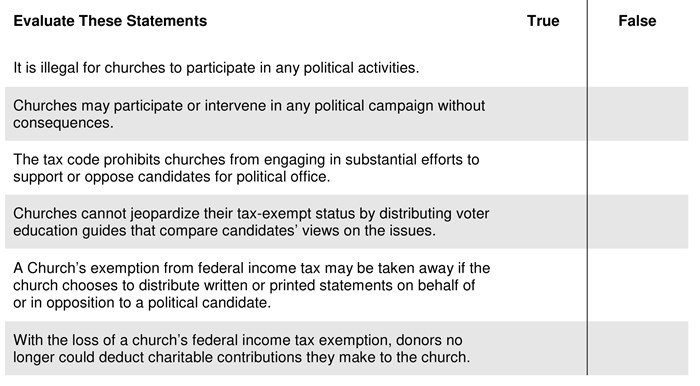

The IRS has clarified tax-deductible assets. Among those not liable for tax deductions are political campaign donations. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

Data on individual contributors includes the following. Contributions to civic leagues or other section 501 c 4 organizations generally are not deductible as charitable contributions for federal income tax purposes. To put it another way financial.

Your tax deductible donations support thousands of worthy causes. Resources for charities churches and. You can obtain these publications free of charge by calling 800-829-3676.

Are Political Donations Tax Deductible Picnic Tax

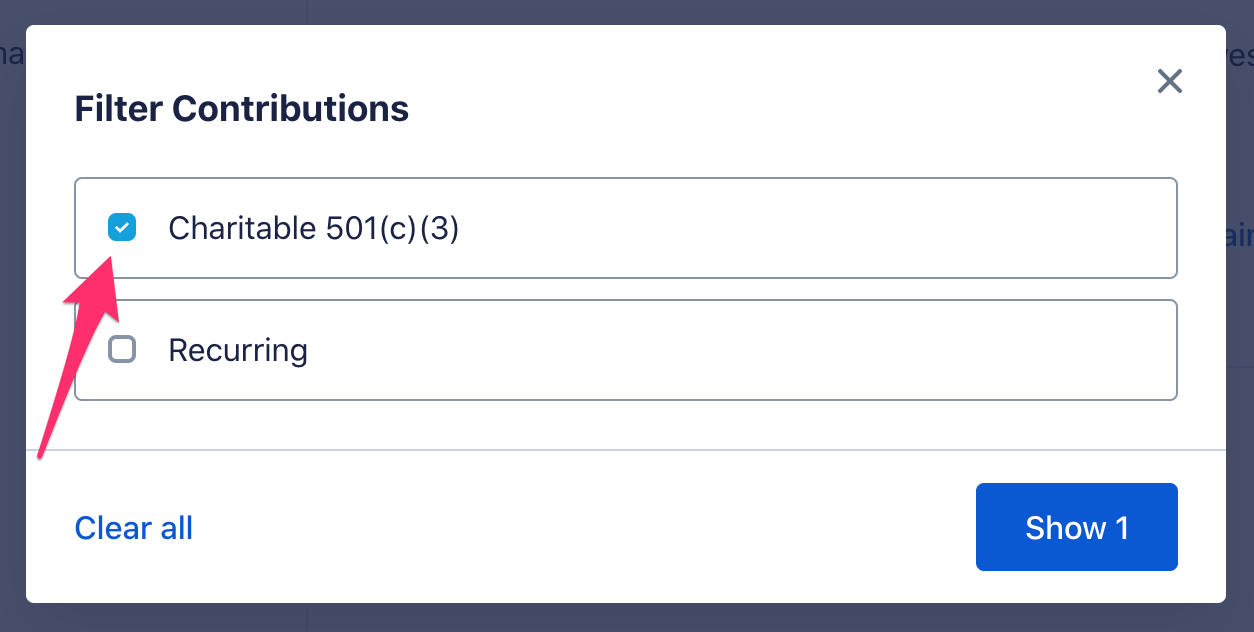

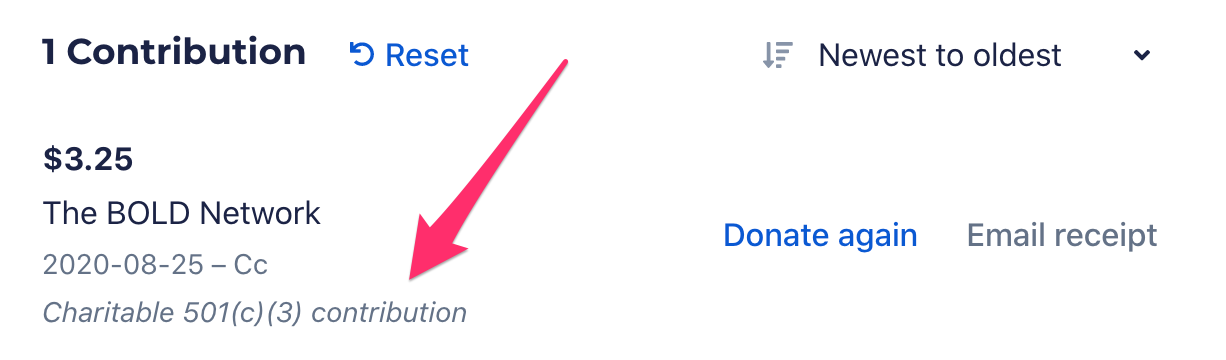

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Political Campaigns And Tax Incentives Do We Give To Get Tax Policy Center

Do We Understand The Effects Of Our Church S Political Activity Church Law Tax

Are My Donations Tax Deductible Actblue Support

Federal Political Financing In Canada Wikipedia

Giving Just Got Easier For Retired Federal Employees Habitat For Humanity Of Greater Los Angeles

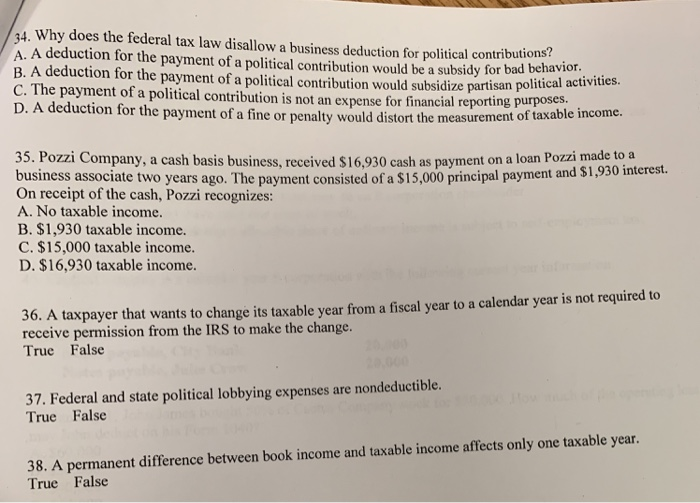

Solved 14 Why Does The Federal Tax Law Disallow A Business Chegg Com

Are Political Donations Tax Deductible

Combined Federal Campaign Donate Through The Combined Federal Campaign Contribute The Foundation For The Malcolm Baldrige National Quality Award

Are Political Contributions Tax Deductible Personal Capital

Are Campaign Contributions Tax Deductible

Are Political Contributions Tax Deductible Anedot

Should You Use A Credit Card To Make A Political Campaign Contribution Fox Business