b&o tax wv

Determine your City of Vienna BO taxable gross income for each of the classifications and enter it in the appropriate box. Washington unlike many other states does not have an income tax.

Parkersburg City Council Continues B O Tax Exemption For Local Businesses Wv News Wvnews Com

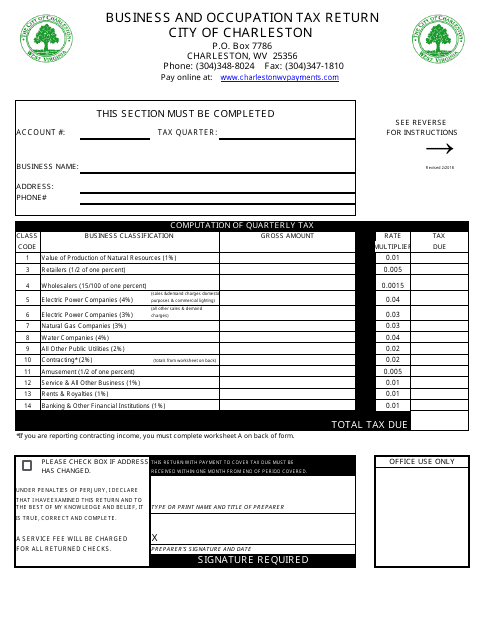

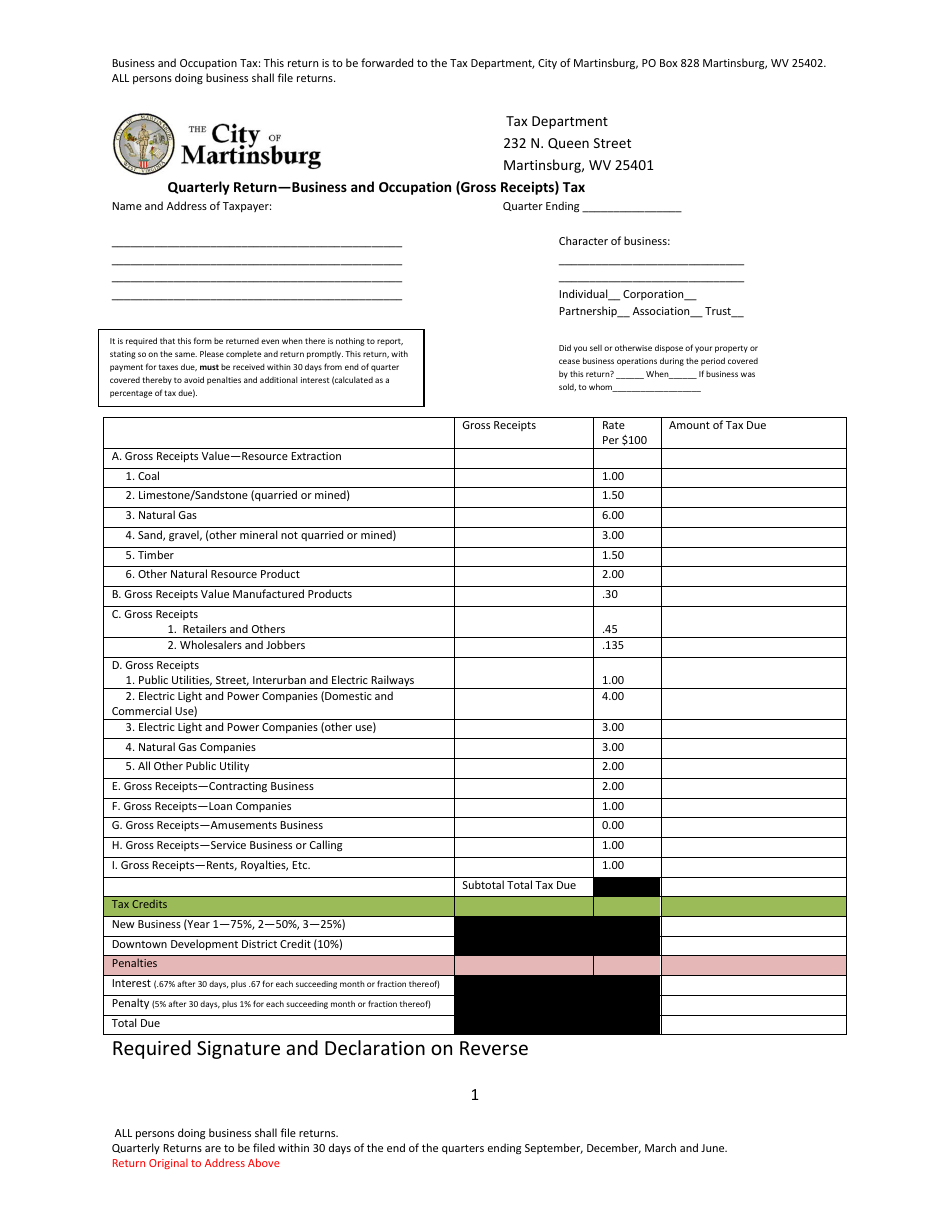

B O Tax There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year.

. Determine your taxes due by multiplying the rate by the taxable income. City of Fairmonts ordinance number 1655 with an effective date of October 8 2015 provides for the imposition administration collection and enforcement of a Consumers Sales and Service Tax and a Complimentary Use Tax of 1 on state taxable sales. Businesses engaged in multiple.

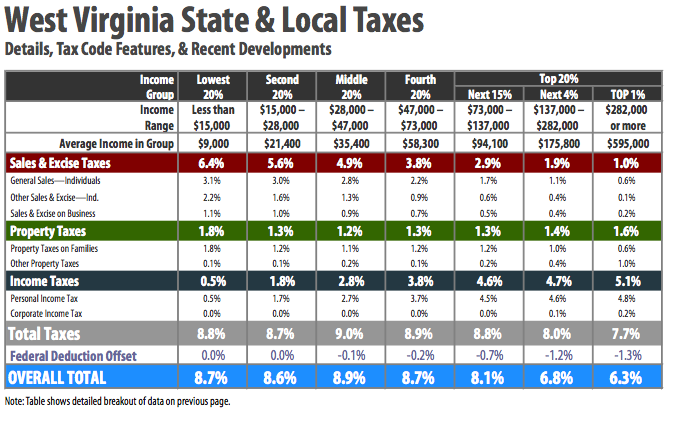

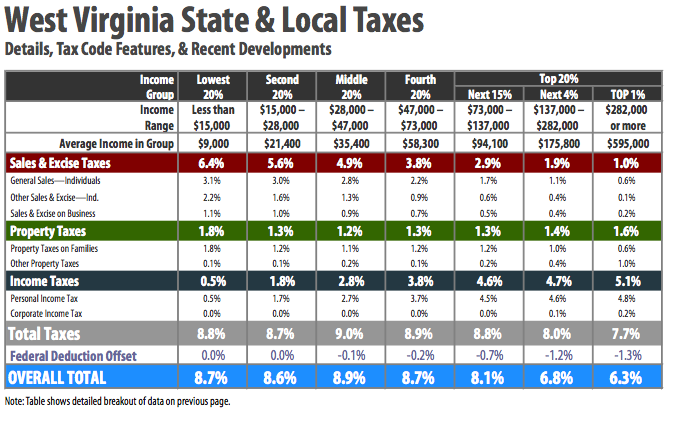

States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky. It is measured on the value of products gross proceeds of sale or gross income of the business. Mayor Williams waived Retail Restaurant Others BO Tax Classification 5 on September 13 2021.

The main revenue source for West Virginia cities is the business and occupation tax generated by any commercial activity locate within the City limits. Schedule I-EPP Industrial Expansion or Revitalization Credit. City of Weirton 200 Municipal Plaza Weirton WV 26062 Phone.

This legislation is effective July 1 2016. Until that time businesses may pay their taxes by visiting city hall between the weekday hours of 9AM and 5PM or mailing the payment to. Washingtons BO tax is calculated on the gross income from activities.

Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for your own records. East Charleston WV 25301 3043488000. The following general principles determine tax liability under the municipal BO Tax.

Charleston West Virginia government works for you. 10000 in gross taxable income times a service rate 5 or 005 equals a BO tax of 50. Business as used in the ordinance setting up this tax structure includes all activities engaged in or caused to be engaged in with object gain of economic benefit either direct or indirect.

For assistance call 3046965540 press option 4 for the Finance Division BO TAXES WAIVED FOR RETAIL RESTAURANT AND OTHER TAX CLASSIFICATION. The state BO tax is a gross receipts tax. We are here to provide you with efficient government services to assist your living recreational work and business needs.

This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. Determine you Charleston BO taxable gross income for each of the classifications and enter it in the appropriate box. This tax is collected from anyone conducting business within the corporate limits of the City of Martinsburg.

The revenue generated by a 1 sales tax will not cover the revenue shortfall created by eliminating BO Taxes which will cause a greater adverse. The West Virginia Municipal Business and Occupation Tax BO Tax is an annual privilege tax imposed on all persons and entities doing business in West Virginia municipalities that impose the tax. Tax Return Form Businesses choose which way to submit Tax returns.

BOT-300G Tax for Gas Storage. PO BOX 2749 Charleston WV 25330. BO Taxes Business and Occupation BO taxes are due twice a year January and July.

The amount of tax is determined by the. The city is currently in the process of developing an online method for paying your BO taxes that should be available soon. It is a type of gross receipts tax because it is levied on gross income rather than net income.

The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US. PO BOX 2749 Charleston WV 25330. BOT-300F Tax Return for Synthetic Fuels.

Business and Occupation Tax Forms. 409 S Kanawha Street. Determine your Business Classifications and corresponding rates from the tax table.

Return by the due date to avoid delinquent notices and tax assessments. Information on BO Taxes for Charleston WV. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

PO Box 2514 Beckley WV 25802. Determine your taxes due by multiplying the rate by the taxable income. Gross income or gross proceeds of sales derived from sales within West Virginia which is not taxed or taxable by any other municipality are included in the measure of Charleston BO Tax if the sales are either directed from a city location or if the taxpayers.

Also effective July 1 2016 the City is reducing the Business and Occupation Tax rate on. The Citys B O Tax is based on the gross income gross receipts of each business. WV Code 8-13C-4b permits municipalities to charge a 1 sales and use tax if they repeal their BO Tax.

Contracting class instructions are listed below 3.

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Wv Sales Pratt Form Fill Online Printable Fillable Blank Pdffiller

Pin By H H On Books West Virginia Virginia True Crime

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

West Virginia Governor S Income Tax Elimination Plan Is Met With Misinformation Misdirection

West Virginia Sales Tax Rates By City County 2022

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

West Virginia Firefighters Share Concerns About Proposal To Slash B O Taxes Wowk

Railpictures Net Photo Csxt 8482 Csx Transportation Csxt Emd Sd40 2 At Selkirk New York By Gary R Schermerhorn Csx Transportation Selkirk Transportation

Wv Report Value Added Opportunities From Natural Gas

Wv Firefighters Concerned About Proposed Bill Slashing Business And Occupation Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

Chapter Iii West Virginia S Economy Industry Focus John Chambers College Of Business And Economics West Virginia University