arizona solar tax credit 2022

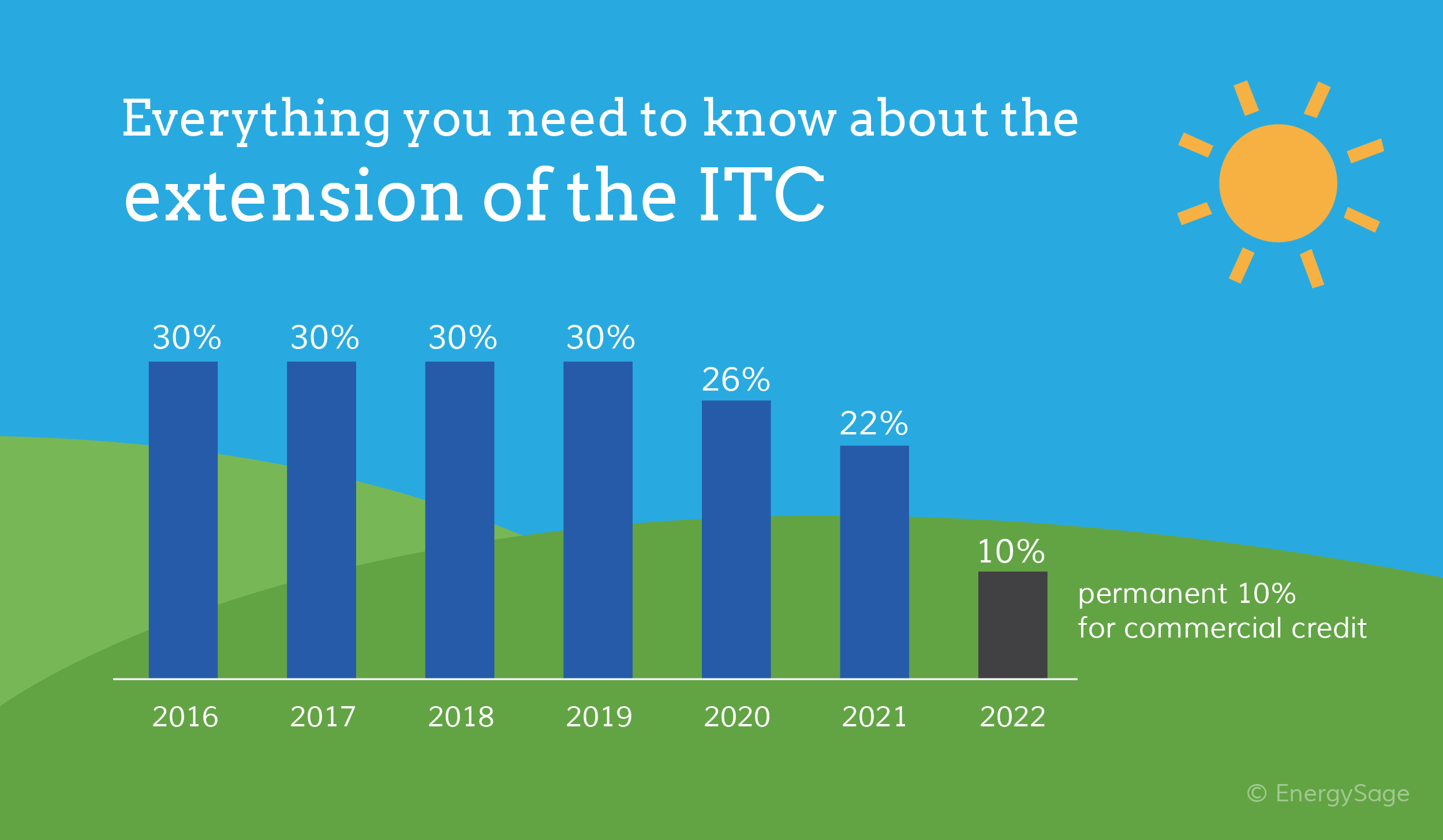

2022 is the last year for the full 26 credit. The tax credit amount was 30 percent up to January 1 2020.

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Solar Tax Credit Step Down Schedule.

. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. So for every 1 you spend on your solar power system you get 30 of that back in a tax credit. This incentive reimburses 25 of your system cost.

The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022. Arizonas Energy Systems Tax Credit. This benefit allows eligible homeowners to reduce the amount of tax they owe by up to 26 of their solar panel installation cost from their federal income taxes.

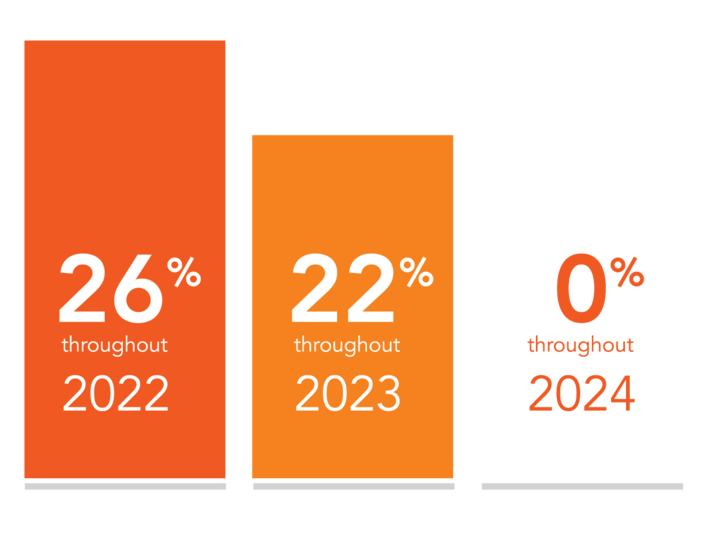

The 26 tax credit will remain available until the end of 2022 decreasing to 22 in 2023. Ad Determine The Right Solar Power Company For You. The federal investment tax credit ITC Using the federal investment tax credit ITC you can claim up to 26 percent of the cost of your solar battery as a credit towards your federal taxes.

An income tax credit is also available at the state level for homeowners in Arizona. In 2023 it drops down to 22 before ending permanently for homeowners beginning on January 1. Read Our Company Breakdowns.

In 2022 the solar investment tax credit or itc offers a. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Ad Step 1 - Enter ZipCode for the Best Powerhome Solar Pricing Now.

Here are the specifics. The residential tax credit is. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

The solar system is new. Arizonans installing a solar-plus-storage system can save thousands on their taxes with the federal investment tax credit ITC. Therefore you arent required to pay any.

The state of Arizona offers residential customers a 25 or 1000 maximum credit per residence of solar installation. Residential arizona solar tax credit one of the most important incentives to help reduce the cost of solar panels in arizona is the residential arizona solar tax credit. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

In the case of Arizona this benefit is combined with a residential state tax credit and two tax exemptions. The credit is allowed against the taxpayers personal income tax in the amount of 25 of the cost of a solar or wind energy device with a 1000 maximum allowable limit regardless of the number of energy devices installed. On March 11 2022 the Maricopa Superior Court ruled that Proposition 208 is unconstitutional and permanently barred collection of the surchargeFor more information click here.

Regardless of where your solar panels are installed in the US you can claim a 26 federal solar tax credit on your next declaration. Ad Check Out Our Wide Variety Of Inventory From Charge Controllers To Inverters To Panels. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies Wind Fuel Cells Geothermal and Heat Pumps.

Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. You are eligible for the solar tax credit if. If the amount of the credit exceeds the taxpayers liability in a certain year the unused portion of the credit may be carried forward for up to five years.

If you use solar to heat your home or water heater instead of using electricity and gas then you can claim 26 percent of the solar system as. -- information on claiming credit for investment in qualified small businesses. The credit is claimed in the year of installation.

23 rows Prop 208. 2022s Top Solar Power Companies. The credit amount allowed against the taxpayers personal income tax is 25 of the cost of the system with a 1000 maximum regardless of.

By Caroline Yu Your Valley Visualizing Arizonas desert landscape the blazing hot sun rises to the front of the mind. What is the solar investment tax credit. And with government interest in creating more renewable energies it begs the question of how much solar energy could be developed within the state.

Arizona also offers a 25 tax credit on solar panel purchases up to 1000 in the year you install your solar panels. The tax credit is 26 in 2022 22 in 2023 and will disappear in 2024 if Congress doesnt renew it. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

Windows 11 is not supported for online forms at this timeWe are working. Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

The federal tax credit falls to 22 at the end of 2022. Shop Northern Arizona Wind Sun for Low Prices Free Ground Shipping For Orders 500. The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program.

To schedule an appointment please contact us at email protected. Equipment and property tax exemptions. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

This incentive is an Arizona personal tax credit. For most homeowners the ITC can help decrease the cost of. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023.

However there will still be a 10 credit for commercial projects only. Arizona State Tax Credit. The solar energy systems that qualify for a 26 tax credit must be placed into service by December 31 2022.

Low Cost Powerhome Solar Options for Less - Hire the Right Pro Today and Save. Net energy metering in Arizona. In 2020 it drops down to 26 and down to 22 in 2021 and in 2022 there will no longer be a tax credit for residential systems.

Income tax credits are equal to 30 or 35 of the investment amount and are claimed over a three year period. Federal Solar Tax Credit. Starting in 2023 the credit will drop to 22.

Most Arizona residents are eligible to receive the Federal Solar Investment Tax Credit also called the Solar ITC. Read User Reviews See Our 1 Pick. Additionally the state offers a sales tax and property tax exemption on solar panels meaning you wont pay.

The solar tax credit is currently available at a rate of 26 through 2022 then at 22 for construction projects that begin in 2023. The 26 federal solar tax credit is available for purchased home solar systems installed by. The 30 credit will only last only through 2019.

The 26 solar tax credit is available through the year 2022. Arizona Solar Tax Credit In Arizona you can claim up to 1000 in tax credits for switching to solar energy. Known as the Residential Solar and Wind Energy Systems Tax Credit this incentive gives you a tax credit of 25 percent for your new solar energy system.

Arizona Residential Solar and Wind Energy Systems Tax Credit. In an April 20 news release the US.

The Solar Investment Tax Credit In 2022 Southface Solar Az

How Does The Federal Solar Tax Credit Work Freedom Solar

Arizona Solar Tax Credits And Incentives Guide 2022

Solar Tax Credit Pays For Solar Yuma Solar Pros 48solar

Solar Tax Credit California Sky Power Solar San Ramon Tri Valley Ca

Us Renewable Portfolio Standards Solar Energy New Uses

Free Solar Panels Arizona What S The Catch How To Get

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

Arizona Solar Incentives And Rebates 2022 Solar Metric

The Extended 26 Solar Tax Credit Critical Factors To Know

Solar Tax Credit California Sky Power Solar San Ramon Tri Valley Ca

Solar Tax Credit In 2021 Southface Solar Electric Az

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

/cdn.vox-cdn.com/uploads/chorus_asset/file/23298503/rsz_adobestock_166916488.jpg)

Federal Solar Tax Credit What Homeowners Need To Know This Old House

Arizona Solar Incentives Arizona Solar Rebates Tax Credits